North Carolina implemented sweeping changes to its auto insurance requirements on July 1,  2025, the most substantial update to the state’s insurance laws in decades. These reforms are a positive step forward for accident victims.

2025, the most substantial update to the state’s insurance laws in decades. These reforms are a positive step forward for accident victims.

The changes raised minimum coverage requirements, made underinsured motorist protection mandatory, and eliminated the liability setoff rule that previously capped recoveries for injured drivers.

For accident victims with NC-issued policies, the reforms can mean substantially higher compensation after a crash.

If you were hurt in a wreck or need help understanding how these new insurance rules affect your claim, the attorneys at Dodge Jones Injury Law Firm would be honored to walk you through your options and explain what coverage applies to your situation.

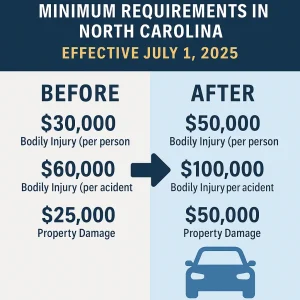

New Car Insurance Minimum Policy Requirements in North Carolina

New and renewed auto insurance policies issued in North Carolina will require substantially higher minimum coverage.

The mandatory liability limits are now $50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $50,000 for property damage.

Before the July 1, 2025 update, the minimum auto liability coverage required for NC-issued policies was:

-

$30,000 for bodily injury per person

-

$60,000 for bodily injury per accident

-

$25,000 for property damage

Those limits had been in place for decades before the General Assembly passed the 2025 reform package that raised them to $50,000 / $100,000 / $50,000 or what accident lawyers may refer to as “50/100/50” coverage.

This represents a significant jump from the previous requirements of $30,000 per person, $60,000 per accident, and $25,000 for property damage.

Key Tip: These new insurance requirements in North Carolina only apply to policies issued or renewed on or after July 1, 2025. If your policy was already in force before that date and hasn’t come up for renewal, you’re likely still operating under the old minimums until your renewal date arrives.

North Carolina Auto Insurance Law Changes

| Coverage Type / Rule | Prior Law | New Law (Effective July 1, 2025) |

|---|---|---|

| Bodily Injury Liability (per person) | $30,000 | $50,000 |

| Bodily Injury Liability (per accident) | $60,000 | $100,000 |

| Property Damage Liability | $25,000 | $50,000 |

| Uninsured Motorist (UM) & Underinsured Motorist (UIM) | UM required at prior limits; UIM optional; liability offset (credit rule) applied | UM & UIM must be included with at least $50,000/$100,000; offset (credit) rule abolished (no more subtracting liability payment) |

| Inexperienced Operator Surcharge Duration | 3 years for new drivers | Expanded to 8 years for drivers first licensed after July 1, 2025 |

| Surcharge for 4+ SDIP Points Violations | 3 years | Now 5 years |

| Lookback Period for PJC / Minor Speeding (≤10 mph) | 3 years | Increases to 5 years for violations incurred after July 1, 2025 |

North Carolina Policies Now Include UM and UIM Coverage

One of the most important changes taking effect July 1, 2025, is the automatic inclusion of uninsured motorist (UM) and underinsured motorist (UIM) coverage in every auto policy issued or renewed in North Carolina.

Before this update, drivers could decline UM and UIM protection, usually without fully understanding what they were giving up.

That option is now gone.

What is MedPay in North Carolina?

Every policy must include UM and UIM coverage that mirrors the liability limits required by law, that being at least $50,000 per person, $100,000 per accident, and $50,000 for property damage.

For people hurt in serious crashes, that additional coverage matters.

When the at-fault driver has no insurance or carries only the minimum, your own policy now steps in automatically.

It creates a broader layer of financial protection and reduces the risk of being left uncompensated because someone else failed to carry adequate coverage.

This change doesn’t eliminate all shortfalls.

High medical costs and lost income can still exceed policy limits.

At the same time, North Carolina policyholders now have a more meaningful backstop when another driver’s insurance falls short.

How Eliminating the Insurance Setoff Can Improve Your Recovery

A major improvement in North Carolina’s 2025 insurance reforms is the end of the liability setoff in underinsured motorist (UIM) claims.

Under the prior system, any money paid by the at-fault driver’s insurance company was subtracted from what your own UIM policy could pay.

That rule consistently favored insurers and limited recovery for people who had taken the responsible step of buying additional coverage.

What You Need to Know About Motorcycle Accidents

It turned UIM protection into an illusion, providing coverage that existed on paper but often provided no real financial benefit (except for the big insurance company’s profit margins).

Removing the setoff eliminates that imbalance.

It allows injured drivers to access the full amount of both the negligent driver’s policy and their own UIM coverage, helping close the gap between serious losses and available compensation.

Here’s how the change works in real terms.

A negligent driver causes a wreck that leads to $100,000 in medical expenses and other losses. Their policy provides $50,000 in bodily injury coverage, and your own UIM policy carries an additional $50,000 limit.

Under the old law, once the negligent “at fault” driver’s insurer paid $50,000, your UIM carrier owed nothing more. Your recovery stopped halfway, and you were left holding the bag and uncompensated for the remainder of your losses.

You paid the premium but the carrier got a financial windfall.

Under the new law, the setoff no longer applies.

You can now recover the $50,000 from the at-fault driver’s policy and another $50,000 from your UIM coverage, reaching the full $100,000 available.

Helpful Information about DRUNK DRIVING Accidents

While that still may not cover the total cost of a serious injury or long-term disability, it’s a significant improvement.

For many North Carolina crash victims, eliminating the setoff closes a loophole that long prevented fair recovery and makes UIM coverage function the way policyholders expected when they paid for it.

The New Under Insured Motorist Standard – UIM Insurance in NC

North Carolina’s 2025 insurance reform also redefined what it means for a driver to be underinsured.

Under the previous law, that determination depended entirely on a comparison of policy limits.

If the at-fault driver’s liability limits equaled or exceeded your UIM limits, your coverage would not apply, even if your actual damages were far higher.

The updated statute shifts the focus from technical limit comparisons to real-world losses.

Now, a driver is considered underinsured when their liability coverage is insufficient to cover the full amount of your damages, not merely because of a numbers comparison between policies.

This change directs attention to what matters most, that being whether the injured party receives the benefits of purchasing the right kind and enough insurance.

It aligns the definition of “underinsured” with the purpose of UIM coverage to fill the gap when another driver’s policy doesn’t cover the harm caused.

Insurers can no longer reduce UIM payments through the liability setoff that once erased much of this coverage.

The only remaining reduction applies to workers’ compensation benefits already paid for the same injuries.

Serving Your Insurance Carrier with a Lawsuit Just Got Easier

Before the 2025 changes, accident victims faced a procedural trap that could destroy an otherwise valid underinsured motorist (UIM) claim.

Even when a lawsuit against the at-fault driver was filed within the statute of limitations, courts required the plaintiff to formally serve the UM or UIM carrier within that same time period. If the carrier wasn’t served before the deadline, the claim was dismissed, even if the insurer already knew about the case.

The new law fixes that problem.

You must still file your lawsuit before the statute of limitations expires, but you no longer have to complete service on the UM or UIM carrier within that same period.

As long as the summons is properly issued and preserved, you can serve the carrier later in accordance with North Carolina’s ordinary rules of civil procedure.

This change puts UM and UIM carriers on the same procedural footing as other defendants and eliminates a harsh technical rule that had nothing to do with the merits of a case – Kevin Jones, NC Car Accident Lawyer

Even so, the safest approach remains the same. File early and serve all defendants, including the UM or UIM carrier, promptly, ideally through the North Carolina Department of Insurance, to avoid unnecessary procedural disputes.

Insurance Rating and Surcharge Changes

The 2025 reform also updated how insurance companies in North Carolina calculate rate surcharges for driving history and experience.

For new drivers who receive their first license on or after July 1, 2025, the inexperienced operator surcharge period expands from three years to eight. The additional years carry smaller increases that taper over time, creating a gradual decline in cost as driving experience grows.

What You Need to Know about Trucking Accidents

Drivers who commit violations worth four or more Safe Driver Incentive Plan (SDIP) points will now face premium surcharges for five years instead of three, excluding certain excessive-speeding offenses governed by separate provisions.

The law also lengthens the lookback period for minor speeding violations of ten miles per hour or less over the limit and for cases resolved through a Prayer for Judgment Continued (PJC). These entries will now remain relevant for insurance-rating purposes for five years rather than three, but only for convictions that occur on or after July 1, 2025.

Together, these adjustments allow insurers to apply risk ratings more gradually while still promoting safe driving and rewarding a longer record of violation-free operation.

The Legislative Path to These Changes

These reforms didn’t happen overnight. The North Carolina Advocates for Justice and other advocacy groups worked through the 2023 and 2024 legislative sessions to push for these changes. Senate Bill 452, which became Session Law 2023-133, and Senate Bill 319, which became Session Law 2024-29, codified these important protections for policyholders and accident victims.

What This Means for Accident Victims

If you have a North Carolina auto insurance policy, it’s worth understanding how these new rules could affect your recovery after a crash. For people injured in serious collisions, the 2025 law changes the calculation of what compensation may be available, particularly for wrecks that occur on or after July 1, 2025, under policies issued or renewed after that date.

Eliminating the underinsured motorist (UIM) setoff is one of the most significant shifts in North Carolina law in decades. In the long term, it will increase the total recovery available to injured drivers and passengers who previously faced restrictive insurance ceilings. Combined with mandatory UIM coverage and improved service-of-process rules, the reform package helps protect accident victims who have been harmed through no fault of their own.

These updates matter most when the stakes are high. Severe injury cases involving catastrophic medical costs, long-term disability, or wrongful death will be evaluated differently under the new law. The outcome may depend on understanding how these changes interact with existing policies and how insurers must now respond to valid UIM claims.

If you were seriously hurt in a crash, Dodge Jones Injury Law Firm represents victims throughout eastern North Carolina in cases involving car wrecks, trucking accidents, and motorcycle accidents. Call now to schedule a confidential consultation 877-622-6671

North Carolina Workers' Compensation News

North Carolina Workers' Compensation News